GET A GREAT

MORTGAGE RATE

GET A GREAT

MORTGAGE RATE

Use one of our quick & easy tools to find out what you qualify for, FREE!

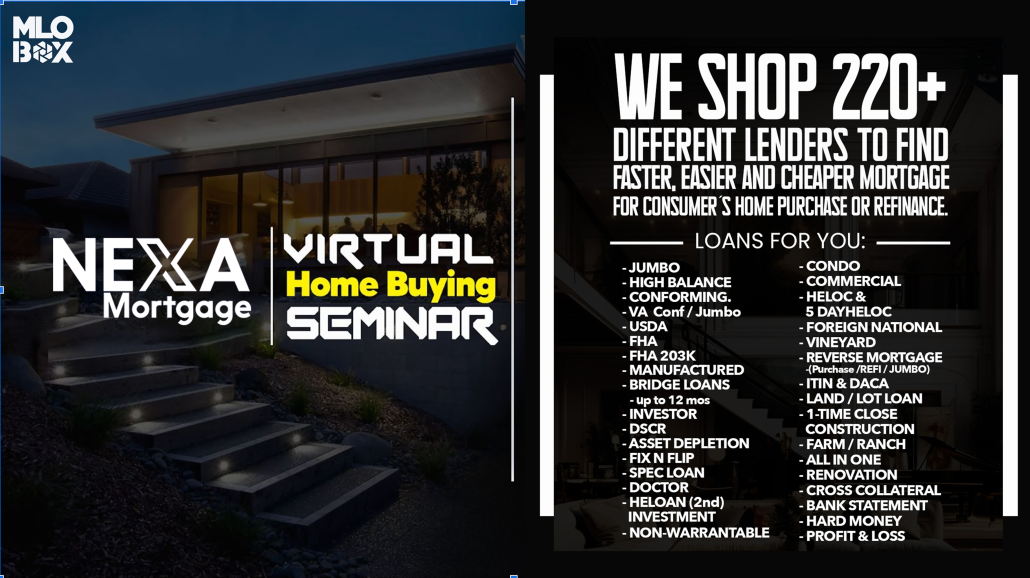

VIRTUAL Home Buying Seminar

1. Understand your costs up front

2. Determine a price range that’s comfortable for you

3. Find out how a real estate agent can help you

4. Learn how your credit score can impact your loan

5. Organize paperwork for a smoother loan process

Loan Programs Available

STE 201, Office 209

Chandler, AZ 85226

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply.

Copyright © 2025 | NEXA Mortgage LLC.

Licensed In: AL, NMLS # 1615600 | NMLS ID 1660690 | AZMB #0944059

Corporate Address : 3100 W Ray Rd

STE 201, Office 209

Chandler, AZ 85226